By Dr Alessandro Merendino

Boards of directors have undoubtedly been facing dramatic challenges, with corporate governance being put at risk, during COVID-19 times.

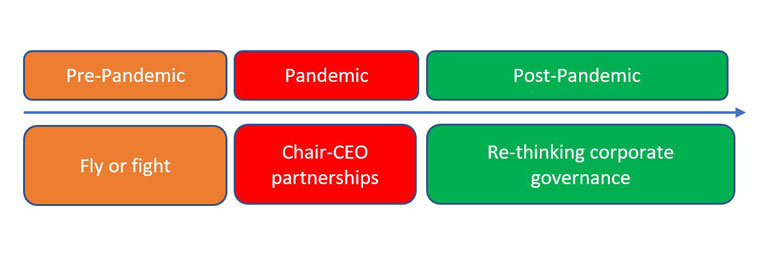

To understand why corporate governance is failing in many organisations, we can divide the COVID-19 crisis into three phases:

- Pre-pandemic or Pre-crisis

- Pandemic or the middle of the crisis

- Post-pandemic or the long tail of the crisis

How have boards of directors reacted during these three phases? Why is corporate governance at risk?

Phase 1. Pre-pandemic – Pre-crisis

In this phase, the board of directors – the core of corporate governance – see the crisis coming over the horizon. They have two choices: fly or fight.

The fly strategy means ignoring a looming crisis. This is a common response, for different reasons. Evidence suggests that directors tend to overlook the early signs of a crisis, and while the board of directors should act as fire fighters (being activated when there is a possible risk), they do not necessarily respond to early warning signs of problems ahead.

The fight strategy occurs when the board of directors steers the company in a new direction, like the captain of a ship avoiding a coming storm.

Unless a particular business is deemed as essential, e.g. supermarkets, pet shops, construction companies and some others, it is interesting to note that in both cases – fly or fight – the result has often been the same: the temporary closure of the company, resulting in corporate governance – and hence the future of the business – being put at risk. In fact, some organisations that apply the fight strategy have moved their business online with better – but not sufficient – revenues.

This leads to the conclusion that corporate governance needs up-to-date instruments to cope with crises. Corporate governance is not necessarily designed to foresee a crisis because boards of directors are often not well equipped to deal with such challenging situations.

Phase 2. Pandemic – the middle of the crisis

During a crisis, the board of directors – together with the top management team – should consider re-designing their business models. This involves re-thinking existing practices, re-vitalising current approaches and finding new ways for the business to survive. During this phase, it is important for the Chair and CEO to work in tandem to establish a successful partnership to survive the crisis.

At times of crisis, the responses of boards tend to fall into three categories:

- The board does not think of any new strategies, and decides to take the easiest solution: to borrow money from the government, while leaving the reconstruction of governance for a later date.

- The board thinks of possible new strategies, but these are only valuable in the short-term. For example, some airlines have put their staff and planes to work supporting the government by rescuing British nationals stranded abroad. However, as soon as this task is completed, the only option is to leave the fleet grounded and ask the government for support.

- The board thinks of a possible new strategy that helps the firm to survive the crisis. For instance, two fashion companies, Barbour and Burberry, re-invented their production lines in order to provide PPE to the NHS.

This leads to the conclusion that corporate governance needs up-to-date tools to avoid ‘freezing’ during a period of crisis. Corporate governance, as represented by boards of directors and senior teams, is often not well placed to steer the organisation through a crisis successfully.

Phase 3. Post-Pandemic – the long tail of the crisis

At the time of writing, the UK has not yet entered into the post-pandemic phase; but based on other countries’ experiences, such as Italy and Spain, UK companies need to be putting in place novel ways to re-start their businesses.

It is no exaggeration to say that corporate governance is being put at risk, due to the challenges of the global pandemic. In too many instances, directors would rather maintain the status quo; too many directors and managers are wedded to existing business models and ways of managing, arguing that ‘this is our backbone, we are not going to change it!’ Too often, directors are reluctant to change – believing that if something has worked in the past, it will continue to work in the future.

This is problematic, because – as demonstrated by some UK Universities – a period of crisis can, in fact, be the right time to re-think corporate governance and re-assess the way directors make strategic decisions. This is the time for directors to be creative and innovative; to embrace new tools to re-invent the business. Digital transformation forces organisations to change, and technology can play a fundamental role in novel strategic decision-making. This is the opportunity to leave behind the status quo and the backbone of the past. The aim is not only business survival, but also a renewal of corporate governance COVID-19 has taught us many lessons, but one such lesson concerns corporate governance: the right time to finally re-invent corporate governance is now.

Comments are disabled