Professor Lyndon Simkin, Executive Director, Centre for Business in Society

Business school students are familiar with the need to assess external trends and developments, to identify how these pose threats or offer opportunities. The PESTLE analysis of forces of the market environment is a long-term bed-rock of business strategy and strategic market planning. Such analyses always throw-up a wide range of forces, many of which are well beyond the control or influence of specific companies and their leadership teams. However, right now such CEOs and senior executives are faced with a level of disruptive change that is unprecedented. Some of this change excites them. Much of what they face simply mystifies them. Much of what is looming is so uncertain or uncharted that they do not know how to respond. And many of these drastic changes to society, supply chains, competition, politics, regulation, technology and to their customers leave them very fearful.

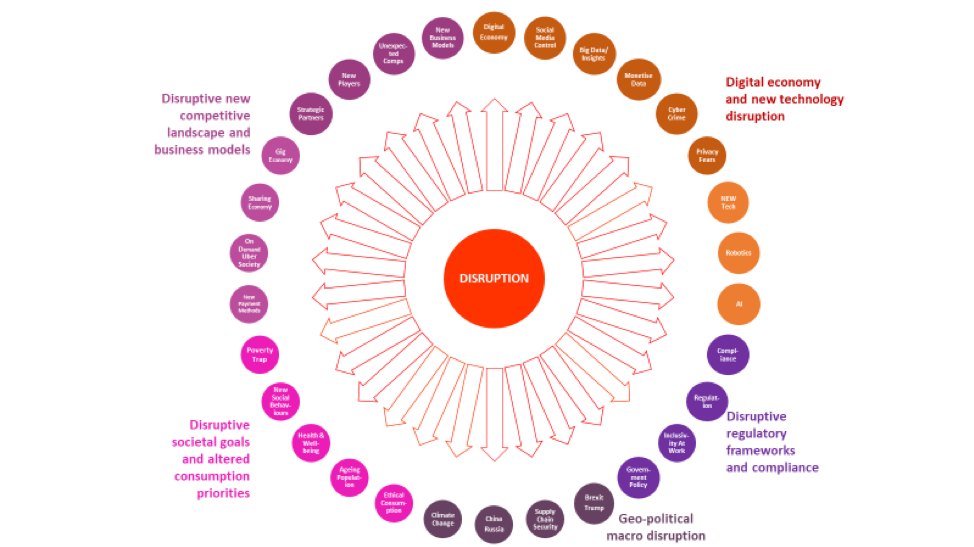

A series of high-level workshops and focus groups of senior executives has identified the market drivers now providing this disruption.

These range from significantly disruptive competition from unexpected players (eg: Google entering the automotive market with Waymo), new business models (eg: Deliveroo or Uber), changing consumption behaviours (eg: resistance to fast fashion, 24/7 mobile shopping, health and wellbeing priorities and the poverty trap), geo-political drivers (eg: Brexit, Trump and the role of China), regulatory pressure (eg: GDPR data privacy or green sustainability compliance), to the many digital and technology drivers (eg: AI and robotics, social media influence or the threat of cyber-crime).

Positive or Negative? Opportunity or Threat?

The Figure below details the top thirty external pressures which CEOs currently fear and believe they must understand. In some instances, these developments present exciting opportunities for growth, new business ventures or strategic partnerships. For some CEOs, they present the opportunity for them to steal an edge over competitors, leverage unexpected revenue streams, monetise their organisation’s capabilities and to themselves massively disrupt a market sector. For all CEOs, however, many of these external drivers of change create significant challenges, hurdles and possibly threats to how they currently operate and deliver their shareholder value. Whether viewed positively or pessimistically, perusal of this set of disruptive developments reveals the unprecedented nature of challenges currently to be navigated.

The Drivers of Change

The digital economy has brought a new wave of competitors, start-ups and even rivals based overseas. Perhaps more surprisingly is the emergence of new business models and businesses in unrelated sectors targeting markets once the domain of others (eg: Tesla and Virgin in space exploration; Google’s Waymo targeting the automotive sector; Uber or Deliveroo on-demand services, and so forth). These competitive forces are truly disruptive and have caused existing players to re-think their strategies and developments. For example, the EV and driverless car trends in automotive have caused the likes or Ford and Toyota to re-think their investments and target market plans, while others such as Jaguar Land Rover have seen a dip in their performance because they have been way too slow to engage in these emerging sectors.

The digital economy has brought a new wave of competitors, start-ups and even rivals based overseas. Perhaps more surprisingly is the emergence of new business models and businesses in unrelated sectors targeting markets once the domain of others (eg: Tesla and Virgin in space exploration; Google’s Waymo targeting the automotive sector; Uber or Deliveroo on-demand services, and so forth). These competitive forces are truly disruptive and have caused existing players to re-think their strategies and developments. For example, the EV and driverless car trends in automotive have caused the likes or Ford and Toyota to re-think their investments and target market plans, while others such as Jaguar Land Rover have seen a dip in their performance because they have been way too slow to engage in these emerging sectors.

The ‘have it now and only when I need it’ emerging behaviour of many consumers has caught many brands by surprise. Once most 17-year-olds aspired to drive and to pass their tests, but now many do not see the point of doing, when instead an Uber is so readily available without the costs of ownership or the hassles of finding parking. The growth of car share clubs is a further dimension of this changing behaviour and attitude to car ownership. Green concerns encouraging some consumers to seek alternative transport solutions further removes a segment of society from potentially being customers of the automotive giants. Ownership of cars, for a variety of reasons, is no longer the routinised desire of all, if alternatives provide the required functionality.

Changing social attitudes and consumption behaviour are prevalent in many examples of disruption. The worries about consumer debt have led to a backlash against the Wongas of this world and for payday lenders, with a host of apps and advice services now emerging to steer people away from such organisations. The TV schedules seem to be full of advice for healthier and more responsible living, avoiding obesity and health crises, consuming less and wasting less. These trends in turn create opportunities for new technologies, products and services, with knock-on implications for established products and brands, which must respond, innovate and bring to market new propositions of their own or lose market share and perhaps even their financial viability.

Most corporate leadership teams are now continually looking to market insight led by big data, AI, robots and apps to alter and streamline their working practices, reduce operating costs, monetise their capabilities, develop new ways of engaging with customers and to stay ahead of rivals. Technology and the digital environment now are huge drivers of change. In addition, big data, growing market insight and eCommerce bring other disruption, with politicians, regulators, the press and consumers all worrying about data security and privacy, leading to the recently introduced GDPR regulation and a host of other measures. Addressing this regulatory environment has caused organisations significant angsts, fearing large fines for non-compliance and ensuing reputational damage. Joining data protection as an impetus for regulatory disruption is the growing raft of green legislation and regulation, with much more anticipated. Responding to such regulatory pressures and demonstrating compliance is now a big cause of corporate disruption, occupying a lot of senior management bandwidth.

And then there are the big macro geo-political pressures and global market environmental forces, such as the decisions of President Trump, Brexit, China’s rise and influence, climate change, terror, security and conflict.

So Why the Angst?

In case you are still left wondering why there is angst amongst CEOs and corporate leadership teams, let’s unpick a couple of these drivers of disruption: increasing regulation and the need to evidence compliance.

The digital era has led to big data and corporate data lakes, with companies accessing never-before seen volumes of customer data and market intelligence, presenting new market understanding and creating a whole industry around analytics and insight. Mis-use of such data, breaches of customer confidentiality, data leaks, fraud and cyber-crime have been high-profile and have affected millions of consumers. This has led to a raft of new regulation, such as the EU’s GDPR regulatory framework introduced last year, General Data Protection Regulation 2016/679. This in turn has forced companies to set up compliance units, audit their practices, alter data storage infrastructure and protocols, invest in training and communication, as well as to develop ways of reporting their compliance. All of which has proved to be hugely disruptive for leadership teams, employees, suppliers and of course customers. These developments have given birth to a new industry of service providers and consultants offering clients services intended to manage these challenges and to mitigate risks of non-compliance for leadership teams.

In the case of impending plans by regulators to force manufacturers to re-use parts from existing products when manufacturing new items – repurposing and recycling – there are huge implications for supply chain management, the capture of such used and discarded parts, their recycling or rendering down, and their return into new manufacturing. Current logistics, operations, partnerships and supply chains simply are not geared to these practices. Neither are consumers or users of the old and redundant products. Of course, new players and service providers will emerge to offer manufacturers help in addressing such challenges, so for some the disruption will provide commercial opportunity. In the situation of regulators seeking evidence of improving carbon footprints, better waste management and greener production, not only will producers and distributors have to change their practices and modify their supply chains, but they will need to identify, capture, store, analyse and report data to support their claims of compliance if audited and quizzed by regulators, the media, special interest groups and increasingly by consumers. Plenty of data experts and technology companies are ready to help their clients in this data challenge. Achieving more sustainable manufacturing and green compliance presents interesting opportunities for a raft of companies, service providers and strategic partners now aiming to assist corporate clients by providing such solutions. Whereas for those involved in manufacturing, these regulatory developments pose hugely disruptive and costly challenges.

And then there are the many other challenges as detailed in Figure 1, posing threats and opportunities and requiring a response from leadership teams. Who’d be a CEO?

Comments are disabled